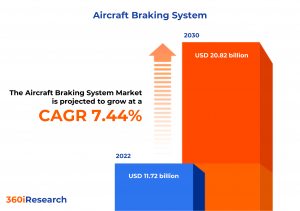

The Global Aircraft Braking System Market to grow from USD 11.72 billion in 2022 to USD 20.82 billion by 2030, at a CAGR of 7.44%.

PUNE, MAHARASHTRA, INDIA , December 5, 2023 /EINPresswire.com/ — The “Aircraft Braking System Market by Component (Accumulator, Actuators, Brake Discs), Actuation (Boosted Brake, Independent Brake, Power Brake), Deployment, End-user, Aircraft Type – Global Forecast 2023-2030″ report has been added to 360iResearch.com’s offering.

The Global Aircraft Braking System Market to grow from USD 11.72 billion in 2022 to USD 20.82 billion by 2030, at a CAGR of 7.44%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/aircraft-braking-system?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The aircraft braking system is critical for ensuring the safety and performance of aircraft during landing, takeoff, and taxiing operations. Braking systems are essential for ensuring aircraft can be securely slowed and brought to a stop during landing and for maintaining position during ground operations, including taxiing and parking. The primary application of aircraft braking systems is to decelerate and stop an aircraft safely during ground operations. The rise in global air traffic, advancements in brake technology, and stringent safety regulations imposed by aviation authorities have expanded the use of aircraft braking systems. Expanding military budgets and developing new aircraft models contribute to the growth of aircraft braking systems. The high cost of advanced material systems and stringent certification standards can limit the use of aircraft braking systems. Additionally, dependence on a limited number of suppliers for specialized components and stringent regulatory norms for aircraft braking systems pose significant challenges to the market. However, adopting new materials, such as carbon composites, presents substantial opportunities for aircraft braking systems. The expansion of the global aircraft fleet and the need to modernize aging aircraft with better braking systems provide considerable commercial prospects. Furthermore, innovations in electric aviation and tilt-rotor craft create new avenues for deploying advanced braking technologies worldwide.

Deployment: Availability of cost-efficient aircraft braking systems in aftermarket channels

The aftermarket channel comprises parts offered after the original sale of the aircraft braking system. The aftermarket channel caters to braking system maintenance, repair, and overhaul (MRO) needs throughout an aircraft’s operating life cycle. Aircraft operators prefer aftermarket channels to ensure compliance with safety regulations, perform regular maintenance, and replace worn or obsolete components. Aftermarket services tend to be more cost-effective in the long run when compared to constantly purchasing new equipment from original equipment manufacturers (OEMs). Operators can source parts from multiple suppliers, which encourages competitive pricing and the availability of a wider range of products. On the other hand, the OEM channel includes manufacturers providing the original aircraft braking systems installed during the assembly of new aircraft. Aircraft manufacturers partner with OEM providers to equip new aircraft with reliable and efficient braking systems. OEM providers are preferred for their cutting-edge technology and the assurance of high-quality, first-generation products.

Aircraft Type: Proliferating usage of aircraft braking systems in fixed-wing aircraft for high degree of control

Fixed-wing aircraft require robust, reliable braking systems to ensure safety during landing and on-ground maneuvering. The braking systems for fixed-wing aircraft typically include brake discs, pads, control systems, and actuators. Preference for braking systems in fixed-wing aircraft inclines toward those that provide high control and redundancy, ensuring safe operation under diverse conditions. Rotary-wing aircraft focused on precise control during hover and low-speed maneuvering rather than high-speed braking. The rotors provide the primary stopping power when airborne, and the wheel-equipped landing gear has brakes for on-ground operations, which are less complex than those found on fixed-wing aircraft. The braking systems for unmanned aerial vehicles are highly specialized, with a preference for lightweight, compact, and recoverable solutions, especially in military applications.

Actuation: Rising preference for power brake systems to enhance the safety and operational efficiency

Boosted brake systems are typically found in smaller aircraft that do not necessitate the complexity of a full-power brake system. Boosted brake systems use the pilot’s input to enhance the braking effect with hydraulic or pneumatic power assistance. Boosted brakes improve performance over unassisted manual systems and are suitable for aircraft that balance the need for enhanced braking power and system simplicity. On the other hand, independent brake systems are often deployed for aircraft that require dual control or where fine control of the braking on individual wheels is necessary. Each main landing gear wheel has its braking unit, and the pilot can operate them separately, which allows for differential braking that can be used to steer the aircraft on the ground. Power brake systems are commonly deployed in large aircraft fleets, including commercial airlines and military jets. Power brake systems offer the highest level of performance and safety, essential for high-speed, heavy aircraft. Power brakes function using hydraulic or electric systems to multiply the braking force applied by the pilot, allowing for effective deceleration and control.

Component: Increasing use of advanced electronics in aircraft braking systems

The accumulator in an aircraft braking system is a hydraulic device used to store pressurized fluid. The need for accumulators is often dictated by the aircraft’s size and the braking system’s complexity. Actuators within the braking system serve to convert the hydraulic or electric control inputs into mechanical force, directly applying or releasing the brakes. Precision and reliability are paramount for actuator preference as they directly affect braking efficiency and safety. Brake discs are the components that interface with the brake pads to slow down the aircraft by converting kinetic energy into thermal energy. The brake housing, or caliper, is the assembly within which brake discs and pads are housed. Brake housing protects the brake’s internal components and ensures optimal operation. The electronics component encompasses the control systems that interpret pilot inputs and sensor data to operate the braking system. These electronic systems include brake control units, anti-skid systems, and monitoring systems that ensure the brakes are applied correctly under various conditions. Valves in an aircraft braking system control the flow and pressure of the hydraulic fluid. The quality and precision valves directly impact the responsiveness and modulation of the braking force. Aircraft wheels are designed to carry heavy loads, provide a mounting place for the braking system, and ensure safe operations during takeoff, landing, and taxi operations.

End-user: Emphasis on advanced braking systems by military sectors to operate in unconventional areas

The commercial users of aircraft braking systems involve braking systems tailored for airliners, regional jets, and business jets. The primary focus of commercial users is on efficiency, reliability, and safety, as these systems are crucial for the high-frequency takeoff and landing cycles of commercial aviation. Passenger airlines, cargo airlines, charter service, air freight, and logistics airlines prefer energy-efficient aircraft braking systems to reduce fuel consumption and ensure operational efficiency. The military segment of the aircraft braking system market focuses on the unique requirements of military aircraft, including fighter jets, transport aircraft, and special mission aircraft. Durability under extreme conditions, compatibility with carrier-based operations, and survivability are critical factors driving the development and procurement of braking systems in the military aviation space. Medical and emergency aircraft, such as air ambulances, need high-performance braking systems for rapid response capabilities. Military aircraft often operate in and out of unconventional runways, which places additional importance on the reliability and effectiveness of the aircraft’s braking mechanisms.

Regional Insights:

The presence of major aerospace corporations, increasing investments in new aircraft fleets, and advancing development in military aircraft have led to the need for advanced aircraft braking systems in the Americas. The Americas region shows significant investments in the aerospace sector, facilitating the adoption of newer technologies in aircraft braking systems. The European Union (EU) landscape for aircraft braking systems observes stringent regulations and high safety standards. Countries including France, Germany, and the United Kingdom represent some of the major aerospace companies that demand cutting-edge technology, including aircraft braking systems, to ensure the operational safety of aircraft. The EU’s environmental policies also push for more environmentally sustainable and efficient braking systems. In the Middle East and Africa, the market for aircraft braking systems is influenced by the expansion of airline fleets and the modernization of existing aircraft. With its key transit hubs and premium airlines, the Middle East highly values aircraft performance, including braking systems. The Asia-Pacific region is experiencing burgeoning growth in the aviation sector. The rapidly growing commercial airline industry and the government’s push for indigenous aircraft production in emerging economies heighten the demand for advanced braking systems. The expanding air travel and military modernization programs are catalysts for increased demand for aircraft braking systems in developed economies across the Asia-Pacific.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Aircraft Braking System Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Aircraft Braking System Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Aircraft Braking System Market, highlighting leading vendors and their innovative profiles. These include AAR CORP., Airbus SE, Aircraft End-of-Life Solutions B.V., AMETEK.Inc., Arkwin Industries, Inc., Astronics Corporation, Aviation Products Systems Inc., Bauer, Inc., Beringer Aero, Collins Aerospace by RTX Corporation, Crane Aerospace & Electronics, Eaton Corporation PLC, Electromech Technologies LLC, GOLDfren, Grove Aircraft Landing Gear Systems Inc., Hindustan Aeronautics Limited, Honeywell International Inc., Hong Kong Aircraft Engineering Company Limited by Swire Group Company, Kaman Corporation, Lee Air, Inc., Leonardo S.p.A., Liebherr-International Deutschland GmbH, Lockheed Martin Corporation, Lufthansa Technik AG, Matco Aircraft Landing Systems, McFarlane Aviation, LLC, Meggitt PLC by Parker-Hannifin Corporation, Moog Inc., NMG Aerospace Components, Northrop Grumman Corporation, OMA SpA, Rapco, Inc., Safran S.A., SAM GmbH, Sonex Aircraft, LLC, Tactair Fluid Controls Inc., Textron Inc., The Carlyle Johnson Machine Company, LLC by RINGFEDER POWER TRANSMISSION GMBH, Umbria Aerospace Systems S.p.A., and Whippany Actuation Systems LLC.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/aircraft-braking-system?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Aircraft Braking System Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Component, market is studied across Accumulator, Actuators, Brake Discs, Brake Housing, Electronics, Valves, and Wheels. The Electronics is projected to witness significant market share during forecast period.

Based on Actuation, market is studied across Boosted Brake, Independent Brake, and Power Brake. The Power Brake is projected to witness significant market share during forecast period.

Based on Deployment, market is studied across Aftermarket and OEM. The Aftermarket is projected to witness significant market share during forecast period.

Based on End-user, market is studied across Commercial and Military. The Commercial is projected to witness significant market share during forecast period.

Based on Aircraft Type, market is studied across Fixed Wing, Rotary Wing, and Unmanned Aerial Vehicles. The Fixed Wing is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas is projected to witness significant market share during forecast period.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Aircraft Braking System Market, by Component

7. Aircraft Braking System Market, by Actuation

8. Aircraft Braking System Market, by Deployment

9. Aircraft Braking System Market, by End-user

10. Aircraft Braking System Market, by Aircraft Type

11. Americas Aircraft Braking System Market

12. Asia-Pacific Aircraft Braking System Market

13. Europe, Middle East & Africa Aircraft Braking System Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Aircraft Braking System Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Aircraft Braking System Market?

3. What is the competitive strategic window for opportunities in the Aircraft Braking System Market?

4. What are the technology trends and regulatory frameworks in the Aircraft Braking System Market?

5. What is the market share of the leading vendors in the Aircraft Braking System Market?

6. What modes and strategic moves are considered suitable for entering the Aircraft Braking System Market?

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

[email protected]

![]()

Originally published at https://www.einpresswire.com/article/672989677/aircraft-braking-system-market-worth-20-82-billion-by-2030-exclusive-report-by-360iresearch